2025 Gift Exclusion - 2025 Annual Gift Tax Exclusion Nelli Libbie, With this change, in 2025, an individual may gift up to $19,000 to an unlimited number of recipients without federal gift tax consequences (meaning the gifts do not consume. Gift Tax Exemption 2025 Understanding The Lifetime Exclusion And Its, To be considered a 2025 gift, the transfer of the money to the child has to be completed by december 31.

2025 Annual Gift Tax Exclusion Nelli Libbie, With this change, in 2025, an individual may gift up to $19,000 to an unlimited number of recipients without federal gift tax consequences (meaning the gifts do not consume.

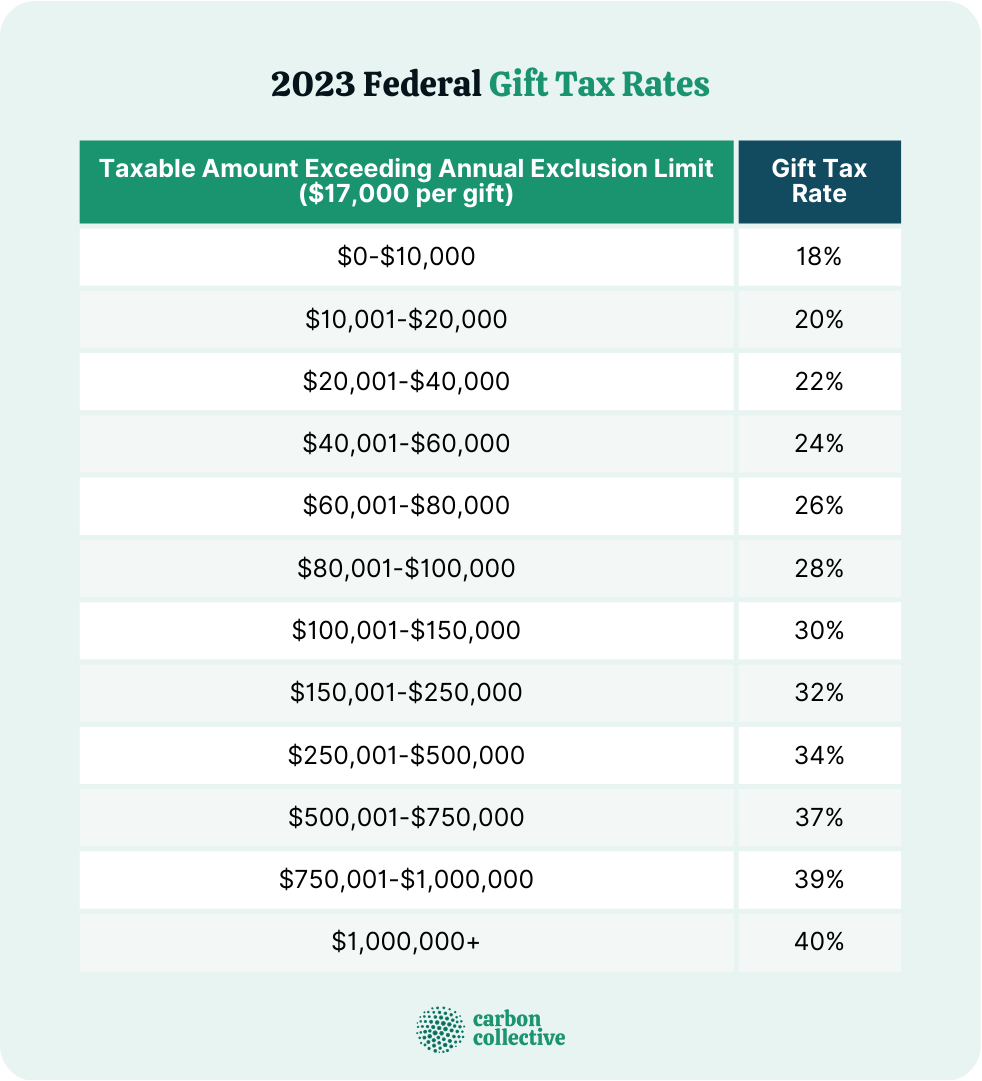

2025 Gift Tax Exclusion Limit Ella Walker, Any gifts that exceed the annual exclusion amount count toward the lifetime exemption.

2025 Annual Gift Tax Exclusion Nelli Libbie, The exclusion will be $19,000 per recipient for 2025.

In 2025, individuals can gift up to $18,000 per person annually, or $36,000 for married couples, without needing to file a gift tax return. The exclusion will be $19,000 per recipient for.

2025 Max Gift Amount Susan Estrella, In other words, giving more than $19,000 to.

2025 Annual Gift Tax Exclusion Nelli Libbie, In 2025, the gift tax exclusion rises to.

2025 Gift Exclusion. Spouses can elect to “split” gifts, which doubles the annual. In other words, giving more than $19,000 to.

Gift Tax 2025 Limit 2025 Zoe Lyman, With this change, in 2025, an individual may gift up to $19,000 to an unlimited number of recipients without federal gift tax consequences (meaning the gifts do not consume.

Understanding the 2025 Gift and Estate Tax Exemption Changes How They, In 2025, individuals can gift up to $18,000 per person annually, or $36,000 for married couples, without needing to file a gift tax return.

Gift Tax 2025 Limit 2025 Zoe Lyman, For the calendar year 2025, the annual gift tax exclusion will increase to $19,000 per recipient, up from $18,000 in 2025.